Car title loans require adherence to specific payment terms, often forbidding mail payments as per agreements. Lenders prefer electronic or in-person transactions for security and swift processing. Defaulting on these terms can lead to penalties, impacting repayment ability. Borrowers should opt for alternative methods like online banking to avoid complications and maintain good credit standing.

Car title loans offer quick cash, but a common question arises: is sending payments by mail safe? While it might seem convenient, this practice could violate your loan agreement. This article delves into the legal implications of car title loan payments sent through the post, highlighting the importance of understanding contract terms. We explore secure borrowing alternatives to avoid potential breaches and provide insights on maintaining a positive relationship with your lender.

- Car Title Loans: Mail Payments and Legal Implications

- Understanding Contract Terms for Secure Borrowing

- Alternative Payment Methods to Avoid Agreement Breach

Car Title Loans: Mail Payments and Legal Implications

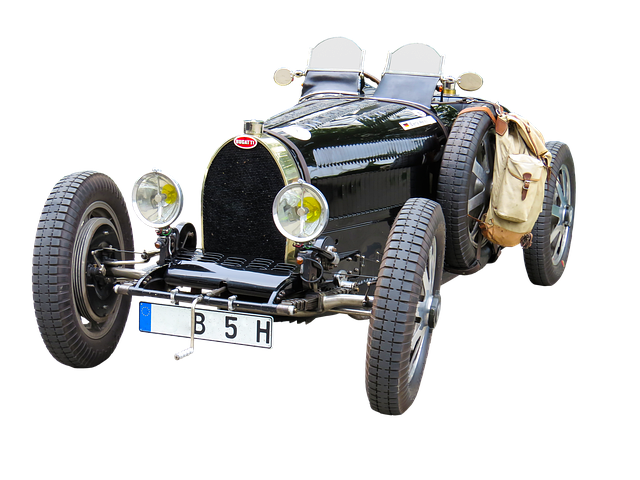

Car title loans, a form of secured lending that uses a vehicle’s title as collateral, have gained popularity for providing quick financial assistance to borrowers. However, when it comes to making payments, some methods may not be in line with the initial loan agreement. Specifically, sending car title loan payments by mail could potentially violate terms set forth by lenders. This is because many agreements stipulate that payments must be made electronically or in-person to ensure timely processing and clear communication.

The legal implications of defaulting on these agreements can be severe, as they often include penalties and interest charges. Additionally, a borrower’s ability to repay the loan may be affected by the lender’s requirement for direct payment methods. While offering flexible payment plans is a common practice, deviating from agreed-upon terms could complicate matters for both parties. Therefore, borrowers should carefully review their loan agreements and consider alternative payment methods, such as online banking or direct debits, to avoid potential legal complications associated with car title loan payments by mail.

Understanding Contract Terms for Secure Borrowing

When considering a car title loan, understanding the contract terms is crucial for secure borrowing. These agreements outline the conditions and expectations, including how and when payments should be made. One method that has gained traction—Car Title Loan Payment by Mail—may seem convenient but could potentially violate specific contractual clauses. Lenders often require direct deposit or other electronic payment methods as per the loan’s terms.

The process of Car Title Loan Payment by Mail might not align with the initial agreement, especially if the contract specifies a different payment approach. Additionally, some lenders may base loan eligibility and interest rates on the speed and security of funds transfer, which can be compromised through mail-in payments. Ensuring that your payments meet the required criteria is essential to maintaining good credit standing and avoiding potential penalties. Furthermore, having an accurate vehicle valuation at the onset, often determined by professional appraisals, is integral to setting fair loan terms.

Alternative Payment Methods to Avoid Agreement Breach

Many car title loan agreements explicitly forbid payments by mail, emphasizing electronic or in-person transactions to ensure prompt processing and reduce risks of fraud. If you’re looking for alternative payment methods to avoid breaching your agreement, consider digital options like online banking transfers, mobile wallets, or automated clearinghouse (ACH) payments. These secure methods allow for real-time updates and accurate record-keeping, aligning with the lender’s requirement for transparency.

For borrowers of specialized loans like semi truck loans, which often come with unique financial assistance programs, these alternative payment channels can be particularly beneficial. Even in scenarios where a no credit check loan is sought, responsible lenders typically prefer traceable transactions to safeguard their interests and maintain regulatory compliance. Therefore, it’s crucial to review your loan agreement thoroughly and opt for approved payment methods to avoid potential issues.

When considering a car title loan, it’s crucial to understand that making payments by mail may violate certain agreement terms. While this method might seem convenient, it could lead to legal complications if your contract specifies electronic or in-person payments. To avoid breaching your agreement and potential penalties, explore alternative payment methods approved by your lender, ensuring secure and compliant borrowing.