Car title loan payments by mail offer a secure, traditional option for borrowers who prefer physical transactions. Processing times are influenced by complex car title structures, postal delays, and financial clearance. To ensure efficient payments, borrowers should prepare documents in advance, allow adequate delivery time, use tracking services, and verify mailing addresses.

“Processing times for car title loan payments by mail can vary significantly. This article delves into the unique considerations surrounding these transactions, highlighting key factors that influence speed and accuracy. From understanding the process to mastering efficient practices, we guide you through navigating the mail-in payment journey. Learn how to optimize your car title loan repayment experience and avoid delays with our practical tips. Efficient management of car title loan payments by mail is achievable – let’s explore how.”

- Understanding Car Title Loan Payments by Mail

- The Factors Affecting Processing Times

- Tips for Efficient and Timely Mail-In Payments

Understanding Car Title Loan Payments by Mail

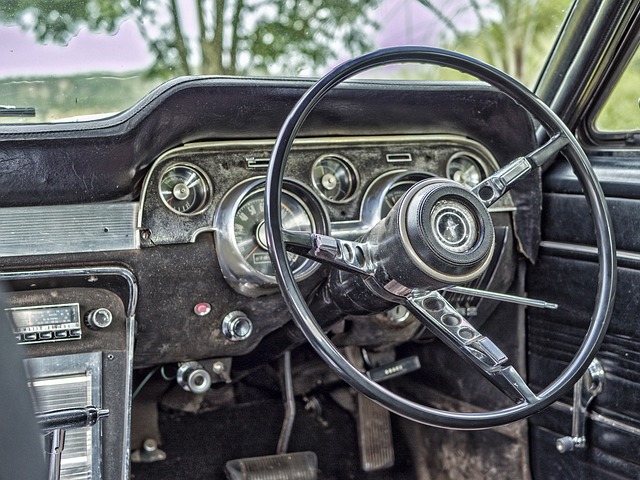

When considering a car title loan as a financial solution, understanding how payments are processed is essential. One unique aspect is the option to make payments by mail, which can be particularly convenient for those who prefer this method or face limited access to digital platforms. This approach involves sending your payment directly to the lender via postal services, ensuring a paper trail of your transactions.

Making car title loan payments by mail offers a secure and reliable financial assistance method. Lenders typically provide specific instructions, including mailing addresses and any required documentation, to ensure timely processing. This option is ideal for those who wish to stick to traditional payment plans or face challenges with online banking.

The Factors Affecting Processing Times

Several factors can significantly influence the processing times for Car Title Loan Payment by Mail. One of the primary considerations is the complexity of the transaction itself. Since car title loans often involve unique financial structures, including variable interest rates and potential loan extensions, each step in the payment process may require additional verification and documentation. This can naturally extend the time it takes to process these payments compared to more conventional loan methods.

Moreover, physical mail processing adds another layer of complexity. The time taken for documents to be received, sorted, and delivered can vary widely based on postal services and regional locations. Additionally, clearing financial transactions and updating records also take time, especially when dealing with third-party financial institutions. Thus, for those seeking Fast Cash through car title loans, understanding these processing dynamics is key to managing expectations regarding turnaround times.

Tips for Efficient and Timely Mail-In Payments

When opting for a car title loan payment by mail, efficiency and timeliness are key to avoid delays. First, ensure you have all required documentation ready before mailing your payment. This includes your loan agreement, recent utility bills, and identification documents. Organizing these in advance streamlines the process and prevents any unnecessary back-and-forth with the lender.

Second, allow adequate time for mail processing. The duration can vary, but planning at least 3-5 business days for delivery and processing is wise. Consider using tracking services for peace of mind and to monitor the status of your payment. Additionally, double-check that the mailing address provided by the lender is correct to avoid any misdelivery or delays caused by incorrect addresses.

Processing times for car title loan payments by mail can vary, influenced by factors like postal delays and document complexity. To ensure timely repayment, borrowers should prioritize accurate documentation, allow adequate time for mailing, and track their packages. Efficient mail-in payments contribute to a positive borrowing experience, demonstrating responsible financial management.